Decoding Core Banking Upgrades:

STRATEGIES, RISKS, AND A GEN 3 CORE RECOLUTION

UNDERSTANDING VALID BUSINESS CASES FOR CORE REPLACEMENT

A KEY CHALLENGE IS DISCERNING GENUINE BUSINESS NEEDS FROM PERCEIVED ISSUES.

Common reasons for replacement include regulatory requirements, outdated systems, cost concerns, business expansion, and the desire for innovation.

However, not all reasons are equally valid, and weak business cases abound. Notably, because core replacements are expensive and potentially risky endeavors, they seldom offer the inflated ROI promised by advisors. A $20 million project with the assurance of a three-year ROI should raise red flags.

INTRODUCTION

FINANCIAL INSTITUTIONS FACE A CRITICAL DECISION WHEN CONSIDERING CORE BANKING SYSTEM REPLACEMENTS.

This complex undertaking requires meticulous planning and execution, leading many to seek expert guidance through the process. In our extensive experience with core banking upgrades, we have observed how institutions consistently underestimate both project complexity and risk, leading to costly missteps and implementation delays.

This article will explore the key strategies for core banking modernization, including different replacement approaches, the emergence of Gen 3 systems, and critical factors for successful implementation that every financial institution should consider before embarking on such a transformative journey.

“A $20 million project with the assurance of a three-year ROI should raise red flags.”

CORE BANKING REPLACEMENT STRATEGIES

MODERNIZING A CORE BANKING SYSTEM INVOLVES VARIOUS STRATEGIES. THE THREE MOST COMMON ARE:

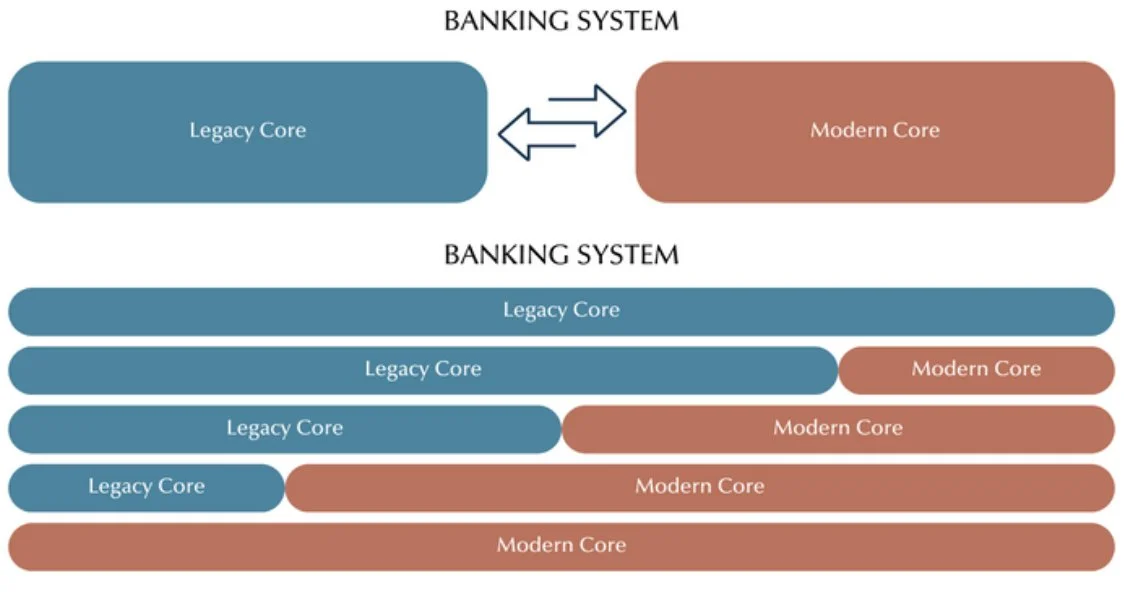

All-at-Once Replacement: Entirely replacing the existing core banking system with a new one in a single “big bang” deployment.

Phased Replacement: Implementing the new core in stages, focusing on one stage at a time, and gradually replacing specific modules or functionalities.

Hybrid Replacement: Integrating the entire new core banking system alongside the existing one, allowing for a more flexible timeline and enabling a gradual transition while maintaining business continuity.

Each of these strategies offers distinct advantages and challenges based on an institution's specific circumstances and risk tolerance. However, while these traditional approaches remain viable, the emergence of Gen 3 core banking systems has introduced new possibilities that expand beyond these conventional methods.

UNDERSTANDING GEN 3 CORE BANKING SYSTEMS

A NOTEWORTHY ADVANCEMENT IN CORE BANKING SYSTEMS IS THE EMERGENCE OF GEN 3 CORE BANKING SYSTEMS.

This architecture lacks a traditional monolithic core architecture, opting for a distributed approach that provides flexibility, scalability, and agility. Components are developed and maintained independently, connected through APIs and other integration methods.

This opens avenues for diverse replacement options. Institutions can adopt a "greenfield" system, conduct a traditional replacement with data migration, coexist with existing systems in a "sidecar" arrangement, or use the “sidecar” implementation to migrate cohorts in purposeful phases from the existing core to a Gen 3 core banking system. This final option is a unique approach that involves running the new core alongside an existing system, gradually introducing new capabilities while leveraging the existing system's strengths.

KEY FEATURES AND BENEFITS OF GEN 3 SYSTEMS

BEYOND THEIR FLEXIBLE ARCHITECTURE, GEN 3 CORE BANKING SYSTEMS OFFER POWERFUL CAPABILITIES THAT TRANSFORM HOW FINANCIAL INSTITUTIONS DEVELOP AND DELIVER THEIR PRODUCTS AND SERVICES.

A further advantage of some Gen 3 systems is their use of smart contracts which facilitate the creation and modification of financial products through developer-friendly code. This grants banks full control over product logic for designing innovative offerings and replicating existing ones.

In addition, real-time platforms allow for instant account arrangements, fee calculations, and interest accruals, eliminating reliance on traditional close-of-business processes. This aligns seamlessly with close-of-business activities, including clearing and settlement.

IMPLEMENTATION CONSIDERATIONS

REGARDLESS OF THE CHOSEN STRATEGY, IT'S CRUCIAL TO REMEMBER THAT THE CORE BANKING SYSTEM IS PART OF A BROADER BANKING ECOSYSTEM

This necessitates evaluation of ancillary systems such as online banking, payments, and Customer Relationship Management. The simple design of a Gen 3 core facilitates seamless API integration and enhances interoperability; however, a comprehensive understanding of organizational requirements and technical capabilities is still essential before embarking on a core banking system replacement, and a robust implementation plan that encompasses testing, training, and ongoing support is critical for a successful transition.

In navigating the intricate landscape of core banking system transformations, having a trusted advisor by your side becomes paramount.

CONCLUSION

YOUR JOURNEY TOWARD MODERNIZATION DEMANDS NOT ONLY A NUANCED APPROACH BUT A COMMITMENT TO THOROUGH PLANNING.

2Oaks offers expert guidance for banks wanting to explore diverse strategies and cutting-edge solutions like Gen 3 core banking systems. To aid institutions in this process, we’ve also published our eBook titled Transforming Banking: An Introduction to Implementing a New System, available for free at 2Oaks.ca.

Ultimately, an in-depth understanding of organizational needs and technical capabilities, a well-executed implementation plan, and expert guidance will pave the way for a success.

Don't let the complexity of core banking modernization delay your transformation journey. Contact 2Oaks Consulting today to access our expertise, proven methodologies, and comprehensive guidance in navigating your path to a successful core banking transformation.