BEYOND THE BUZZWORD

What AI Means For Financial Institutions Today

INTRODUCTION

The COTS Dilemma

WHEN BUYING SOFTWARE NO LONGER MAKES SENSE

Financial institutions have operated under a simple software paradigm for decades: buy proven, off-the-shelf solutions to minimize risk and development costs

For some of our client organizations, this means annual software licensing expenses ranging from $300,000 to over $1 million just for core systems like ERP, plus additional costs for CRM, marketing automation, and specialized financial applications.

This established approach is facing its first serious challenge in decades.

AI-enabled development is fundamentally changing the economics of custom software creation, forcing financial leaders to reconsider whether purchasing software still makes financial sense when building bespoke solutions has become dramatically more cost-effective.

Understanding the New Development Economics

FROM MONTHS TO WEEKS

Recent real-world results demonstrate the scale of this shift. Our AI implementation partner organization created a sophisticated, productionready application that would traditionally require 8 months with 3 developers (24 person-months of effort) in 3 weeks with 1 developer using AI development tools. This represents a 92% reduction in development time and resources.

This isn't an isolated case or marketing hyperbole. Organizations are systematically using AI tools like Cursor and Windsurf to compress development timelines while maintaining code quality and engineering standards. The implications extend far beyond faster delivery. They are challenging the fundamental cost structure that has made purchasing software more attractive than building it.

AI-Enabled Development

HOW IT ACTUALLY WORKS

AI development tools function differently than traditional automation. Instead of replacing developers, they augment human expertise with AI agents that act as architects, project managers, and coordinators:

CODE GENERATION AND TESTING:

AI writes application code, creates comprehensive test suites, and validates functionality while developers focus on business logic validation and strategic decisions.

ARCHITECTURE AND PLANNING:

AI analyzes requirements and generates initial system architecture, database schemas, and integration approaches based on established engineering patterns.

LEGACY SYSTEM INTEGRATION:

AI can analyze existing systems and generate integration code, reducing the complexity of connecting new applications to established infrastructure.

DOCUMENTATION AND MAINTENANCE:

AI automatically generates and maintains technical documentation in sync with code changes, eliminating the chronic problem of outdated or insufficient documentation.

Real-World Applications

FOR FINANCIAL INSTITUTIONS

For organizations primarily using commercial off-the-shelf (COTS) software, AI development offers solutions to persistent operational challenges:

Documentation and Knowledge Management

Most financial institutions struggle with outdated runbooks, incomplete system documentation, and knowledge concentrated in individual team members. AI can systematically review existing systems, generate current documentation, and create automated runbooks for common operational tasks.

Production Support and Incident

Response AI can analyze historical incident patterns, generate standardized response procedures, and even automate routine troubleshooting steps. This reduces dependency on institutional knowledge held by specific individuals and improves response consistency.

Legacy System Modernization

Instead of expensive system replacements, AI can help organizations modernize legacy codebases incrementally: adding modern interfaces, improving security, and enhancing functionality without full system replacement.

Integration and Data Flow

AI excels at creating integration layers between disparate systems, enabling better data flow and reducing manual data entry across multiple platforms.

FAQ

ADDRESSING THE KEY IMPLEMENTATION QUESTIONS

-

A: Yes, but the applications are different. AI's value for COTS-heavy organizations lies in operational efficiency, system integration, and addressing maintenance tasks that traditional software vendors don't prioritize.

-

A: AI development still requires technical oversight to validate outputs and ensure security and compliance standards. However, the technical skill requirements are shifting toward validation and architecture rather than detailed coding expertise

-

A: Focus on time savings in operational tasks, reduced dependency on external vendors for customizations, and elimination of manual processes. Many organizations see positive ROI within 12-18 months through operational efficiency gains alone.

-

A: AI-generated code requires the same testing, security review, and compliance validation as human-written code. The advantage is that AI can generate comprehensive test suites and documentation more consistently than manual development processes.

The Strategic Choice

BUY, BUILD, OR HYBRID

The emergence of AI-enabled development creates a third option beyond traditional "build versus buy" decisions. Organizations can now consider:

Pure COTS Approach: Continue with purchased software, accepting limitations and ongoing licensing costs.

AI-Enabled Custom Development: Build bespoke solutions that exactly match business requirements at costs approaching COTS pricing.

Hybrid Strategy: Use COTS for commodity functions while building custom solutions for competitive differentiators or unique operational requirements.

The optimal choice depends on specific organizational factors, but the calculation has fundamentally changed. Custom development is no longer automatically the more expensive, higher-risk option.

Implementation

CHALLENGES AND CONSIDERATIONS

Data Quality and Governance:

AI development depends on clean, well-structured data. Organizations must address data quality issues before expecting optimal results from AI tools.

Technical Oversight:

Despite AI assistance, organizations still need team members who understand software engineering principles to validate AI outputs and ensure proper security and compliance.

Organizational Change:

When development timelines compress dramatically, traditional approval processes and project management approaches may become bottlenecks.

Vendor Relationships:

Reducing dependence on software vendors requires careful planning around support, updates, and feature development responsibilities.

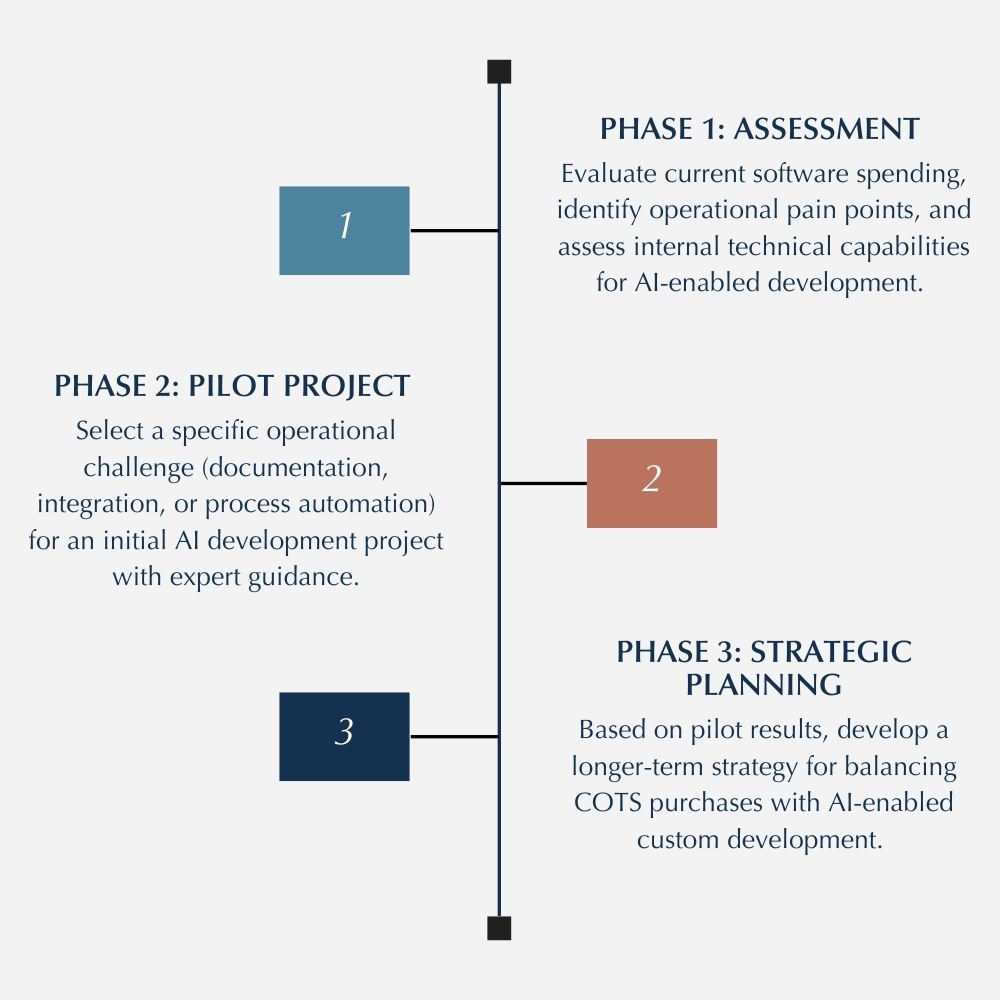

Getting Started

A PRACTICAL APPROACH

Recognizing this paradigm shift, 2Oaks has partnered with AI implementation experts who are already delivering these outcomes for clients in real-world environments. Our collaborative approach focuses on practical implementation rather than theoretical possibilities:

The goal isn't to eliminate all purchased software, but to make strategic decisions based on current economics rather than outdated assumptions about custom development costs and timelines. Our partnership approach ensures organizations have both the strategic guidance and technical expertise needed to navigate this transition successfully.

The Path Forward

AI-enabled development represents the first fundamental shift in software economics in decades. For financial institutions, this creates an opportunity to reduce software licensing costs, improve operational efficiency, and build competitive advantages through bespoke solutions.

The organizations that will benefit most are those that approach AI implementation strategically, focusing on specific business problems rather than technology for its own sake, building internal capabilities gradually, and measuring results rigorously.

The question is no longer whether AI will change how financial institutions approach software decisions. That question has already been answered with a resounding yes. Now, the question has become how quickly leaders will recognize and adapt to the new economics of custom development.

Ready to take the next step in your organization's strategic AI journey with an experienced and practical partner?

Contact 2Oaks to learn how our collaborative approach can help you focus on what really matters for your organization and its unique needs.

Follow our LinkedIn page for our more helpful information on practical AI implementation.

DOWNLOAD THE FULL SERIES BELOW:

ABOUT 2OAKS

2Oaks is a consulting services company specializing in banking, financial technology, enterprise systems, and management.

Our expertise lies in bridging the gap between technology, business, and management to simplify complexity and drive successful outcomes.