FINDING THE BALANCE

THIRTY YEARS AGO, YOU WERE MORE LIKELY TO HEAR ABOUT ARTIFICIAL INTELLIGENCE IN A SCIENCE FICTION NOVEL THAN A BUSINESS REPORT.

Today, artificial intelligence (AI) and machine learning (ML) have moved from fiction to reality and new practical business applications emerge every day. As organizations race to implement these technologies, the conversation has shifted from "if" to "how" we should integrate AI into our workflows and customer experiences. This article will help you find the right balance for your business.

WHAT IS IT?

DEFINITIONS

Artificial Intelligence refers to computer systems designed to perform tasks that typically require human intelligence. These include problem-solving, language understanding, visual perception, decision-making, and adapting to new situations. Machine Learning, a subset of AI, focuses on systems that can learn from and improve with experience without being explicitly programmed for every scenario.

Modern AI systems range from rule-based algorithms to sophisticated neural networks that can process vast amounts of data to recognize patterns, make predictions, and generate human-like content. Deep learning, a specialized form of machine learning, uses multi-layered neural networks to analyze complex data such as images, speech, and natural language.

KEY APPLICATIONS:

Key applications include:

Natural Language Processing (NLP) for understanding and generating human language

Computer Vision for interpreting visual information

Predictive Analytics for forecasting trends and behaviours

Automated Decision Systems for making or supporting complex choices

Robotics and process automation for physical and digital tasks

WHY IT MATTERS

SIGNIFICANCE:

The significance of AI and ML extends beyond technological advancement—it represents a fundamental shift in how businesses operate and how people work. Organizations in banking, financial services, commerce, and the public sector implementing AI solutions can achieve remarkable improvements in efficiency, customer experience, and innovation capacity.

TRANSFORMATION:

AI is already transforming these industries by:

Enabling personalized experiences at scale

Automating routine and repetitive tasks

Uncovering insights from massive datasets

Accelerating research and development

Creating new products and services previously impossible

Enhancing regulatory compliance and fraud detection

Improving risk assessment and management

However, as with any powerful technology, the implementation approach determines whether AI enhances or diminishes the human experience.

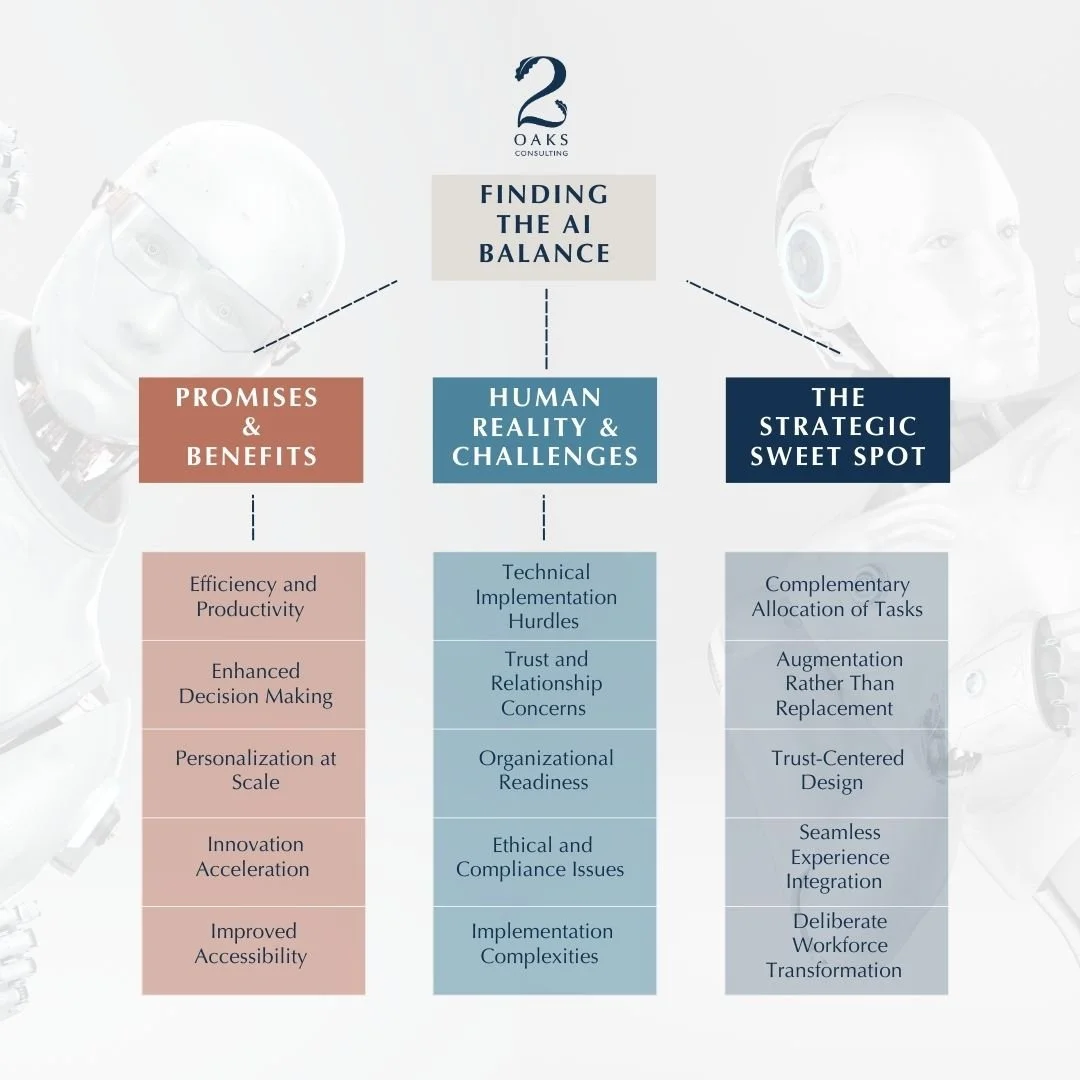

THE PROMISE & BENEFITS OF AI

As organizations implement AI and machine learning solutions, they quickly discover that success lies not in wholesale adoption but in thoughtful integration. Understanding both the promise and reality of these technologies is essential for finding the optimal balance.

AI TECHNOLOGIES OFFER COMPELLING ADVANTAGES ACROSS INDUSTRIES.

Efficiency and Productivity

Immediate 24/7 responsiveness to customer and operational needs

Processing vast amounts of data beyond human capacity

Automating repetitive tasks with unwavering consistency

Significant cost savings through operational streamlining

Enhanced Decision Making

Data-driven insights that reduce cognitive biases

Pattern recognition across massive datasets

Predictive capabilities that anticipate needs and problems

Consistent application of complex rules and regulations

Personalization at Scale

Customized experiences for thousands or millions of users simultaneously

Adaptive interfaces that learn from user behaviour

Tailored recommendations and solutions

Real-time adjustments to user preference

Innovation Acceleration

Rapid testing of multiple hypotheses

Identification of non-obvious connections and opportunities

Simulation of complex scenarios

Creative generation of new product and service concepts

Improved Accessibility

Breaking down language and communication barriers

Creating interfaces adaptable to diverse needs

Expanding service availability beyond traditional constraints

Democratizing access to specialized knowledge

THE HUMAN REALITY AND CHALLENGES

HOWEVER, IMPLEMENTATION OFTEN REVEALS SIGNIFICANT CHALLENGES:

Technical Implementation Hurdles

Frustrating interaction loops when systems can't understand context

Integration difficulties with legacy systems

Data quality and availability constraints

Costly infrastructure and expertise requirements

Trust and Relationship Concerns

Erosion of trust in sensitive client-advisor relationships

Lost context during handoffs between AI and human representatives

Depersonalization of traditionally high-touch services

Transparency issues with "black box" decision systems

Organizational Readiness

Workforce anxiety about changing roles and responsibilities

Skills gaps for effective AI implementation and management

Resistance to process changes required for AI adoption

Governance challenges for algorithmic decision-making

Ethical and Compliance Issues

Potential amplification of existing biases in training data

Privacy concerns with data collection and usage

Regulatory uncertainty in rapidly evolving landscapes

Accountability questions for automated decisions

Implementation Complexities

Difficulty defining appropriate success metrics

Challenges in moving from pilot to production

Ongoing maintenance and monitoring requirements

Security vulnerabilities in connected systems

THE STRATEGIC SWEET SPOT

THE MOST SUCCESSFUL ORGANIZATIONS FIND A MIDDLE PATH THAT LEVERAGES THE STRENGTHS OF BOTH AI AND HUMAN CAPABILITIES:

Complementary Allocation of Tasks

Using AI to handle routine, repetitive processes

Reserving human attention for complex decisions and relationship building

Creating clear protocols for when issues should escalate to human intervention

Augmentation Rather Than Replacement

Deploying technology to enhance professional expertise

Providing AI tools that amplify human capabilities

Designing systems that make humans more effective, not obsolete

Trust-Centered Design

Building solutions that strengthen rather than dilute client trust

Ensuring appropriate transparency in AI-driven processes

Maintaining human oversight for sensitive decisions

Seamless Experience Integration

Creating invisible transitions between automated systems and human experts

Ensuring context preservation during handoffs

Delivering consistent experience quality across all touchpoints

Deliberate Workforce Transformation

Retraining employees to work effectively with AI systems

Creating new roles that leverage uniquely human skills

Developing governance frameworks for human-AI collaboration

This balanced approach recognizes that the goal isn't efficiency at the expense of effectiveness but rather finding the optimal combination that enhances both operational performance and human experience. Success with AI technology requires maintaining the personal touch while leveraging AI's capabilities to enhance service delivery.

FINDING THE RIGHT BALANCE

WHAT MAKES FOR SUCCESS?

The most successful AI implementations recognize that the goal isn't to replace humans but to enhance human capabilities. This means:

Start with human needs: design AI systems that address real pain points for employees and customers

Create collaborative workflows: establish clear handoffs between AI systems and human experts

Maintain human oversight: ensure humans remain in control of sensitive decisions and edge cases

Invest in skills development: prepare employees to work effectively alongside AI tools

Measure holistic impact: evaluate AI not just on efficiency metrics but on customer and employee satisfaction

REAL-WORLD EXAMPLE:

JPMORGAN CHASE’S COIN PLATFORM

JPMorgan Chase provides an excellent case study of finding the balance between AI capabilities and human expertise in financial services. In 2017, the bank introduced COIN (Contract Intelligence), an AI-powered system designed to review and interpret commercial loan agreements.

THE PROBLEM

Previously, interpreting these complex legal documents consumed approximately 360,000 hours of work annually from lawyers and loan officers. The process was not only time-consuming but prone to human error and inconsistency.

THE AI SOLUTION

COIN uses machine learning and natural language processing to:

Extract key data points from loan documents

Identify critical clauses and terms

Flag potential issues for human review

Standardize interpretation across thousands of contracts

THE HUMAN COMPONENT

Rather than eliminating the role of legal professionals, JPMorgan Chase redesigned their workflow:

AI handles the initial document review and data extraction

Legal experts focus on analyzing flagged issues and edge cases

Relationship managers use the extracted insights to provide better client advice

The legal team maintains oversight of the system and regularly reviews its accuracy

THE RESULTS

This human-AI collaboration has delivered significant benefits:

99% reduction in document review time (from hours to seconds)

Decreased loan-servicing mistakes

More consistent contract interpretation

Improved client experience with faster processing

Legal staff redeployed to higher-value advisory work

These results have been reported in multiple sources, including JPMorgan Chase's own technology publications, Bloomberg, and Harvard Business Review. The initiative is part of the bank's broader strategy to use AI and machine learning to improve efficiency and accuracy across operations.

Most importantly, JPMorgan recognized that the system works best with human oversight. Legal professionals regularly review the AI's interpretations and provide feedback that improves the algorithm. This creates a virtuous cycle where the AI system becomes more accurate while the human experts develop new skills and focus on more strategic work.

This example demonstrates how financial institutions can leverage AI to handle routine processing while enhancing, rather than replacing, the human expertise that clients ultimately value most.

INDUSTRY-SPECIFIC APPLICATIONS

BANKING AND FINANCIAL SERVICES

Beyond contract review, AI is revolutionizing financial services through:

Fraud detection systems that identify suspicious patterns in real-time

Credit scoring models and loan adjudication systems that assess risk more accurately, process applications more efficiently, and make lending decisions more inclusively

Customer service chatbots that handle routine inquiries, with seamless handoffs to human advisors for complex matters

Algorithmic trading with human oversight for market anomalies

Anti-money laundering systems that flag suspicious transactions for human investigation

COMMERCE

In the retail and e-commerce sectors, the human-AI balance is equally important:

Inventory management systems that predict demand patterns while buyers add market intuition

Recommendation engines that personalize offerings while human merchandisers curate collections

Dynamic pricing models with strategic overrides from pricing managers

Customer journey analytics informing human-designed experiences

Supply chain optimization with human judgment for unusual circumstances

PUBLIC SECTOR

Government agencies are finding their own AI-human balance through:

Benefits processing automation with case workers focusing on complex situations

Predictive maintenance of infrastructure with engineer oversight

Public safety analytics informing but not replacing human decision-making

Citizen service platforms that route complex needs to appropriate staff

Policy impact modeling to inform human policymakers

CONCLUSION

THE FUTURE OF AI ISN'T ISN'T A BINARY CHOICE BETWEEN TECHNOLOGY AND HUMANITY. RATHER IT IS A CAREFUL CONSIDERATION OF WHERE EACH EXCELS.

Organizations in banking, financial services, commerce, and the public sector that approach AI implementation with this mindset will be best positioned to realize its benefits while mitigating its challenges.

As you navigate your AI journey, remember that the goal should be enhancing, not replacing, the human touch that builds relationships and trust. With thoughtful implementation, AI can handle routine tasks while freeing people to do what they do best: connect, create, and care.

Need help finding the sweet spot? 2Oaks can help you navigate the complexities of your AI journey in banking, financial services, commerce, and public sector environments. Our expertise in these industries ensures solutions that balance technological innovation with human-centred design.

DOWNLOAD THE PDF DOCUMENT BELOW:

ABOUT 2OAKS

2Oaks emerged from deep within the banking sector, where our founders personally navigated the challenges of core system modernization. This hands-on experience shaped our unique approach to technology consulting—one that combines technical expertise with practical wisdom. We're not your typical consultancy. As a vendor-neutral partner, we work exclusively for our clients' interests across banking, financial services, retail, and public sectors.

What sets us apart is our commitment to co-creation and knowledge transfer. We work alongside your team, ensuring that our solutions aren't just implemented but truly integrated into your organization. Our lean, efficient approach eschews unnecessary complexity in favour of practical, results-driven outcomes. Whether you're facing a system transformation, technology upgrade, or strategic shift, reach out to 2Oaks to discover how our principled, authentic approach can drive your success.