THE HIDDEN RISKS OF ANCILLARY SYSTEMS IN CORE BANKING TRANSFORMATION

Why Your Core Banking Project Success Depends On Systems You Might Overlook

BY ANDREW MILLS

INTRODUCTION

IN THE RUSH TO MODERNIZE CORE BANKING SYSTEMS, FINANCIAL INSTITUTIONS OFTEN OVERLOOK A CRITICAL COMPONENT OF THEIR TECHNOLOGY ECOSYSTEM: ANCILLARY SYSTEMS.

These supporting systems—from payment gateways and CRMs to loan origination platforms—play vital roles in daily operations. Their oversight during core system replacement can lead to significant challenges that impact both operations and customer experience.

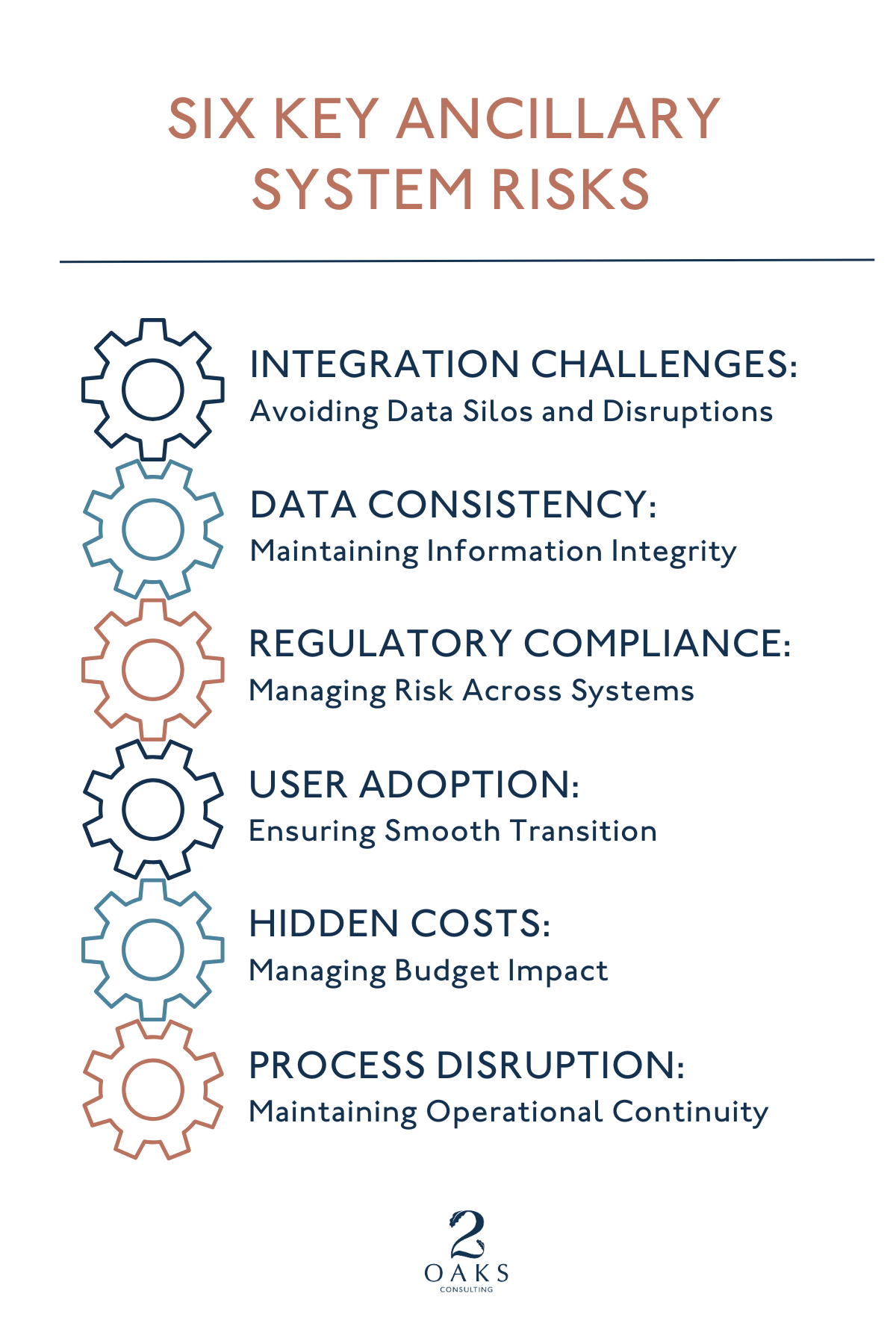

This guide explores six key risks associated with ancillary systems during core banking transformation projects and provides practical solutions to address them.

1. INTEGRATION CHALLENGES: AVOIDING DATA SILOS AND DISRUPTIONS

THE RISK:

Ancillary systems are deeply woven into a bank's operational fabric. When these systems aren't properly integrated with the new core, institutions face data silos, operational inefficiencies, and potential service disruptions that directly impact customer experience.

THE IMPACT:

Fragmented customer information across systems

Inefficient manual processes to bridge system gaps

Increased operational overhead

Potential service delays and disruptions

THE SOLUTION:

Engage in early and thorough planning for system integration. Mapping all touchpoints and system dependencies between the core and ancillary systems ensures data flows smoothly, minimizing disruption. Testing integrations in advance with a dress rehearsal allows teams to identify and resolve potential conflicts in a controlled environment before they impact operations.

PRO TIP:

Create a detailed integration blueprint before beginning the core replacement. Document all existing integrations and validate each one's compatibility with the new core system.

2. DATA CONSISTENCY: MAINTAINING INFORMATION INTEGRITY

THE RISK:

New core banking systems introduce different data structures and formats. Without proper planning, this can lead to inconsistencies between the core and ancillary systems, affecting everything from reporting to customer service.

THE IMPACT:

Inaccurate reporting and analytics

Compromised decision-making capability due to outdated or incorrect data

Risk of regulatory non-compliance

Customer service issues due to inconsistent data

THE SOLUTION:

Develop a comprehensive data management strategy that includes synchronization across all systems, not just the core. Regularly, iterative testing and validating data flows between systems will help ensure consistency, improve reporting accuracy, and support compliance. Pay particular attention to critical customer and transaction data.

PRO TIP:

Implement automated data reconciliation tools to monitor for discrepancies and reduce the risk of human error. Establish clear data governance protocols before, during, and after the transformation.

3. REGULATORY COMPLIANCE: MANAGING RISK ACROSS SYSTEMS

THE RISK:

Many ancillary systems play crucial roles in regulatory compliance, from AML systems to transaction monitoring tools. Overlooking these during core replacement can create significant compliance gaps and expose an organization to serious regulatory risk, fines, and reputational damage.

THE IMPACT:

Potential regulatory violations

Increased risk of fines and penalties

Compromised audit trails

Gaps in regulatory reporting

THE SOLUTION:

Involve compliance teams early in the planning process and maintain continuous dialogue throughout the transformation. Create a compliance checklist specific to ancillary systems, mapping data usage and implementing controls as necessary while also maintaining detailed documentation of all compliance-related system changes.

PRO TIP:

Conduct regular audits and compliance assessments throughout the transformation process to help identify gaps and prevent future issues.

4. USER ADOPTION: ENSURING SMOOTH TRANSITION

THE RISK:

When ancillary systems undergo changes alongside core systems, employees need time and training to adapt to the new workflows. Insufficient training and poor change management can cause staff to struggle to adapt, leading to mistakes, frustration, and resistance among users.

THE IMPACT:

Decreased operational efficiency

Employee frustration and resistance

Increased error rates

Customer service degradation

THE SOLUTION:

Implement a comprehensive change management plan by developing an end-to-end training program that covers both core and ancillary system changes. Actively gather feedback from end users during the training sessions to identify and address their concerns and improve the process. Throughout the entire project, provide ongoing support for all affected staff and maintain regular communication by sharing progress updates, announcing key milestones, and promptly addressing any issues that arise.

PRO TIP:

Create a network of "super users" who can provide peer support and act as change champions throughout the organization.

5. HIDDEN COSTS: MANAGING BUDGET IMPACT

THE RISK:

The complexity of ancillary system integration often leads to unexpected costs that can strain project budgets and disrupt timelines. These hidden expenses typically emerge from compatibility issues, data migration challenges, and the need for specialized technical expertise.

THE IMPACT:

Budget overruns

Extended project timelines

Unexpected resource requirements

Increased total cost of ownership

THE SOLUTION:

Build a detailed cost model that includes all aspects of ancillary system integration, including testing, training, and post-implementation support. By identifying potential cost drivers upfront, teams can allocate budget and resources more accurately, reducing the risk of surprise expenses and last-minute adjustments.

PRO TIP:

Add a 20-30% contingency specifically for ancillary system-related challenges and unexpected integration requirements. Further, set clear expectations with vendors, ensuring that all services required for successful integration are specified in your contracts.

6. PROCESS DISRUPTION: MAINTAINING OPERATIONAL CONTINUITY

THE RISK:

Many banking processes span multiple systems. Poor integration of ancillary systems disrupts these processes, creating workflow bottlenecks and daily operational challenges and inefficiencies. These disruptions lead to slower service, increased errors, and mounting frustration for both staff and customers.

THE IMPACT:

Broken workflow chains

Increased manual intervention requirements

Extended processing times

Compromised customer experience

THE SOLUTION:

Before beginning any system transformation, thoroughly analyze and map all cross-system business processes, creating detailed process flows that document system interdependencies. This comprehensive analysis reveals hidden dependencies and will allow teams to anticipate challenges and prepare for smoother transitions. Test these mapped processes extensively before implementation to ensure workflows remain efficient and uninterrupted across all departments.

PRO TIP:

Implement process monitoring tools to quickly identify and address any disruptions during and after the transformation.

CONCLUSION

THE SUCCESS OF YOUR CORE BANKING TRANSFORMATION DEPENDS NOT JUST ON THE CORE SYSTEM ITSELF, BUT ON HOW WELL IT WORKS WITH YOUR ENTIRE TECHNOLOGY ECOSYSTEM.

Overlooking ancillary systems can lead to significant risks that impact both short-term project success and long-term operational efficiency.

Addressing and mitigating these six key risks, taking the time to plan and test, and validating all system interactions will help ensure a truly successful transformation.

Don't let ancillary system challenges derail your core banking transformation. Contact 2Oaks today to tap into our expertise in managing complex system integrations. Our experience in navigating these hidden risks will help ensure your transformation project delivers the operational efficiency and customer experience improvements you expect.

DOWNLOAD THE PDF DOCUMENT BELOW:

ABOUT 2OAKS

2Oaks emerged from deep within the banking sector, where our founders personally navigated the challenges of core system modernization. This hands-on experience shaped our unique approach to technology consulting—one that combines technical expertise with practical wisdom. We're not your typical consultancy. As a vendor-neutral partner, we work exclusively for our clients' interests across banking, financial services, retail, and public sectors.

What sets us apart is our commitment to co-creation and knowledge transfer. We work alongside your team, ensuring that our solutions aren't just implemented but truly integrated into your organization. Our lean, efficient approach eschews unnecessary complexity in favour of practical, results-driven outcomes. Whether you're facing a system transformation, technology upgrade, or strategic shift, reach out to 2Oaks to discover how our principled, authentic approach can drive your success.