THE PROBLEMS NOBODY WANTS TO SOLVE

HOW AI CHANGES THE EQUATION

The “Too Hard” Bucket

WHEN NEED OUTPACES AVAILABLE RESOURCES

Every financial institution has critical projects that consistently get pushed to the bottom of the priority list

These aren't nice-to-have initiatives or future-state visions. They're important operational improvements that never quite make it past the planning stage because they can't compete with revenue-generating projects for resources.

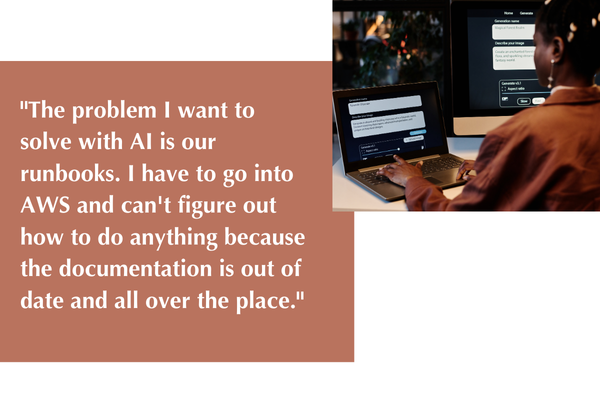

"The problem I want to solve with AI is our runbooks" a technology leader recently shared. "I have to go into AWS and can't figure out how to do anything because the documentation is out of date and all over the place. " This frustration reflects a universal challenge: organizations know what needs fixing, but the effort required has always exceeded the available resources.

AI is fundamentally changing this equation by making previously resource-intensive tasks economically viable.

Why These Problems Persist

COMMON CHARACTERISTICS OF COMMON PROBLEMS

MAINTENANCE NATURE:

They involve ongoing upkeep rather than one-time improvements, requiring sustained attention that's hard to maintain.

RESOURCE INTENSITY:

They require significant human effort but deliver operational rather than strategic value, making them difficult to justify against competing priorities.

LIMITED BUSINESS CASE:

While operationally important, they rarely generate direct revenue or cost savings large enough to justify traditional project investment.

KNOWLEDGE DEPENDENCIES:

They often rely on institutional knowledge held by specific individuals, creating both bottlenecks and risk.

Consider the familiar scenario: a critical system expert holds decades of institutional knowledge, but documenting that knowledge would take months of their time. Often, this is time the organization can't spare from daily operations.

The AI Advantage: Economics of Automation

FROM NEGLECTED TO SOLVED

AI development tools change the fundamental economics of these neglected problems by dramatically reducing the human effort required to address them.

Recent implementations demonstrate this shift in practice. One of our clients completed a repository-wide code improvement project using AI, adding comprehensive unit tests and modernizing their legacy codebase. This work never would have received budget approval through traditional channels. The same approach applies to many operational challenges financial institutions face daily.

Real Problems AI Can Address Today

NO LONGER WAITING FOR THE FUTURE

Outdated Documentation and Runbooks

Almost every financial institution struggles with documentation that's either missing, incomplete, or years out of date. IT teams waste hours reconstructing processes that should be documented, while new employees struggle to understand systems without proper guidance.

AI can systematically review existing systems, analyze configuration files and code repositories, and generate current documentation. More importantly, it can maintain this documentation automatically as systems change, eliminating the recurring problem of outdated information.

Legacy System Knowledge Transfer

Many institutions depend on individuals who understand complex legacy systems built over decades. This creates both operational risk and career limitations for those individuals who become indispensable.

AI can analyze legacy system architectures, document integration patterns, and create comprehensive guides for system maintenance and troubleshooting. This doesn't replace human expertise but creates organizational knowledge that isn't dependent on individual availability.

Production Support Standardization

Most organizations handle production incidents through a combination of institutional knowledge, incomplete documentation, and individual expertise. This leads to inconsistent response times and resolution approaches.

AI can analyze historical incident patterns, generate standardized response procedures, and create automated diagnostic tools. The result is more consistent support quality and reduced dependency on specific team members for critical issues.

Integration Complexity

Financial institutions typically run dozens of interconnected systems, each with its own data formats, APIs, and integration requirements. Creating and maintaining these integrations consumes significant development resources.

AI excels at analyzing system interfaces and generating integration code, making it economically viable to create better data flow between systems and reduce manual data entry processes.

Compliance and Audit Trail Maintenance

Regulatory compliance requires extensive documentation and audit trails, work that's essential but rarely generates business value. Traditional approaches require significant manual effort to maintain proper records.

AI can automatically generate compliance documentation, maintain audit trails, and flag potential regulatory issues before they become problems, reducing both manual effort and compliance risk.

The Resource Allocation Shift

NEW SOLUTIONS MEAN NEW STRATEGIC CHOICES

When these operational problems can be addressed at a fraction of their traditional cost, organizations face new strategic choices about resource allocation.

Instead of choosing between fixing documentation or developing new features, teams can do both. Instead of deferring system integration improvements indefinitely, they become economically viable projects.

The constraint shifts from resource availability to project prioritization and change management.

This creates opportunities for financial institutions to improve operational efficiency while simultaneously investing in growth initiatives, a previously impossible combination given traditional resource constraints.

Implementation Considerations

STEPS FOR A SMOOTHER TRANSITION

Start with Assessment:

Identify which operational problems create the most daily friction for your teams. These high-impact, resource-intensive tasks are ideal candidates for AI-enabled solutions.

Pilot Approach:

Select one specific problem area for initial implementation. Success with documentation automation, for example, can demonstrate value before expanding to more complex challenges.

Quality Standards:

AI-generated solutions require the same validation and testing as any operational system. The advantage is speed of implementation, not elimination of quality control.

Change Management:

When longstanding problems can suddenly be solved, teams need time to adapt workflows and processes to take advantage of new capabilities.

The Strategic Opportunity

FREEDOM TO FOCUS ON WHAT MATTERS MOST

For financial institutions, addressing these neglected operational problems creates multiple benefits beyond immediate efficiency gains.

Improved documentation and standardized processes reduce operational risk and improve regulatory compliance. Better system integration enables more effective data analysis and reporting. Reduced dependency on individual knowledge holders improves both operational resilience and employee satisfaction

Moving Beyond Maintenance Mode

The ability to economically address operational challenges represents a fundamental shift from maintenance mode to improvement mode. Organizations can stop accepting frustrating inefficiencies as inevitable and start viewing them as solvable problems.

A partner organization recently noted: "We went from having a massive backlog of maintenance tasks we couldn't justify to being able to tackle operational improvements while still delivering new features. The constraint isn't resources anymore. Now we simply have to decide which improvements to prioritize. "

This shift from resource-constrained to priority-constrained decision-making opens new possibilities for operational excellence while maintaining focus on strategic growth initiatives.

The question for financial institution leaders becomes: which long-deferred operational improvements would have the biggest impact on your organization's effectiveness? For the first time in years, the answer doesn't have to be "we'll get to it when we have time”.

Ready to take the next step in your organization's strategic AI journey with an experienced and practical partner? Contact 2Oaks to learn how our collaborative approach can help you focus on maximizing impact and efficiencies in your business.

Follow our LinkedIn page for our more helpful information on practical AI implementation.

DOWNLOAD THE FULL ARTICLE BELOW (CLICK ON THE IMAGE)

ABOUT 2OAKS

2Oaks is a consulting services company specializing in banking, financial technology, enterprise systems, and management.

Our expertise lies in bridging the gap between technology, business, and management to simplify complexity and drive successful outcomes.